AAM (advanced air mobility) revolution has taken a big step forward for Textron Aviation in executing its strategic plan this year. Alongside rival Embraer, it is the only other mainstream business aircraft manufacturer to be assembling a credible product portfolio of electric and autonomous aircraft.

The U.S. aerospace and defense group sees the new sector gaining serious momentum from around 2030, and by then several new electric aircraft could potentially enter service alongside the ubiquitous King Air and Caravan turboprop families, as well as the Citation business jets.

With the formation of its eAviation division in March 2021, Textron signaled its ambitions under the leadership of former Textron senior vice president of sales and marketing Rob Scholl. In April 2022, the surprise acquisition of electric aviation pioneer Pipistrel well and truly turned theory into practice, paving the way for several new aircraft being developed.

This deal appears to have revitalized Textron’s eVTOL vehicle plans at its helicopter division Bell. After having seemed content to allow the industry to assume this project was on hold, Scholl confirmed to AIN that Bell is now building its first prototype and plans to have it flying by 2024 or 2025.

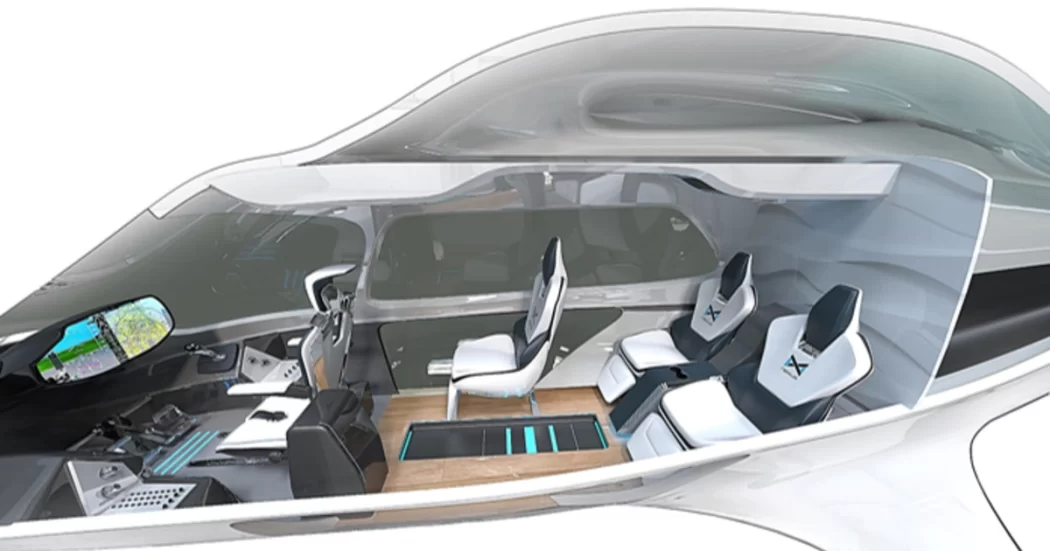

According to Scholl, his design weighs 8,000 pounds, has a 50-foot wingspan, and has a range of 100 nautical miles. According to us, this is a pragmatic choice based on technological and regulatory considerations.

As a result, the Nexus has a significantly higher range than earlier iterations, which were only expected to fly around 60 miles. In order to comply with current FAA vertical flight regulations, the wingspan of the new Nexus has been increased. It will be capable of flying at 120 kts.

A series of earlier technology demonstrators Bell has developed over the past five years is markedly different from the larger, longer-range model presented at the NBAA press conference on Monday. It features a four-stationary rotor system for vertical lift and two tilting rotors for converting to cruise flight with the same dimensions as the Grand Caravan.

As a result of new infrastructure requirements, especially in the area of airspace management, as well as new regulations, Textron sees AAM services taking a bit longer to gain momentum than start-up rivals aiming for launch in 2024 or 2025. Scholl stated, “We must focus more on how we can increase airspace capacity and how we can get aircraft communicating with one another.”. Textron is the company that is capable of achieving this.

As he sees it, ground infrastructure for eVTOL operations is less of an immediate imperative, since the new services can be implemented primarily with existing infrastructure, rather than by “building hundreds of new vertiports.” Textron intends to contribute to the implementation of the AAM building blocks by building on its long-established relationship with leading regulators like the FAA and EASA.

Approximately 50 engineers work on the Nexus program, most of whom are based at Textron’s Pawnee Campus Glass House in Wichita. In addition to Bell’s engineering resources, the team includes colleagues from Pipistrel (who provide battery expertise) and other Textron units, such as Kautex and McCauley.

In spite of its willingness to accelerate Nexus’s path to market, Textron appears to believe that fixed-wing electric aircraft have a larger market potential. In particular, Textron wants to increase its customer base in Europe by gaining FAA approval for Pipistrel’s Velis Electro trainer.

As part of its plans to step up certification for Pipistrel’s Panthera general aviation model, Textron announced plans at this summer’s EAA AirVenture show in Oshkosh, Wisconsin. A new Lycoming piston engine powers the standard model at first, but Scholl pointed out that as part of the Horizon 2020 Mahepa research and development backed by the European Union, the group’s new Slovenia-based subsidiary has already flown a hybrid-electric technology demonstrator.

Nuuva, a family of uncrewed cargo air vehicles from Pipistrel, has been added to the eAviation mix as well, including the V300 model that is in development. For middle-mile freight distribution, this has already been deployed for airspace integration testing in Europe.

In addition to its unmanned intelligence, surveillance, and reconnaissance platform, the Slovenian company also offers the Surveyor. Approximately 30 hours of flight endurance can be achieved by this medium-altitude model.

The Miniliner, also developed by Pipistrel, bears a passing resemblance to Textron’s Beech 1900 commuter plane.

Small airports with little or no scheduled airline service will be connected to larger international gateways by the Miniliner on routes of about 300 miles. Despite its longer timeline than other market opportunities now preoccupying eAviation, Scholl said this project is still in the works.

Cessna Grand Caravan will be electrified by ZeroAvia, a hydrogen propulsion system developer. It is anticipated that the turboprop single will be fitted with the 600 kW ZA600 powertrain by 2025 once a supplemental type certificate is obtained.

“Getting the business economics right is a big part of the challenge for sustainable aviation,” concluded Scholl. “Textron is uniquely positioned to lead the AAM sector. Few companies will make it to market and be successful.”