Using more Class A shares priced at $1.30, Lilium has raised $119 million in capital. German eVTOL aircraft developer announced its equity offering on November 18, when its stock was trading at around $1.54 on the New York Stock Exchange.

According to Lilium, investors include Honeywell and Aciturri from the aerospace industry, as well as LGT, Lightrock, Tencent, and B. Riley Securities. As individual investors, Klaus Roewe, Barry Engle, David Wallerstein, and Niklas Zennström, Lilium’s new CEO, and board members, are also participating in Lilium’s 91 million share offering. Lilium is already backed by LGT, Tencent, and Niklas Zennström.

Lilium already relies on Honeywell Aerospace and Aciturri for avionics and propulsion. In addition to Lilium, Honeywell has invested in other eVTOL aircraft developers such as Volocopter and Vertical Aerospace. As part of its partnership with Japan’s Denso group, Honeywell is supplying the Lilium Jet with avionics, flight controls, and electric motors.

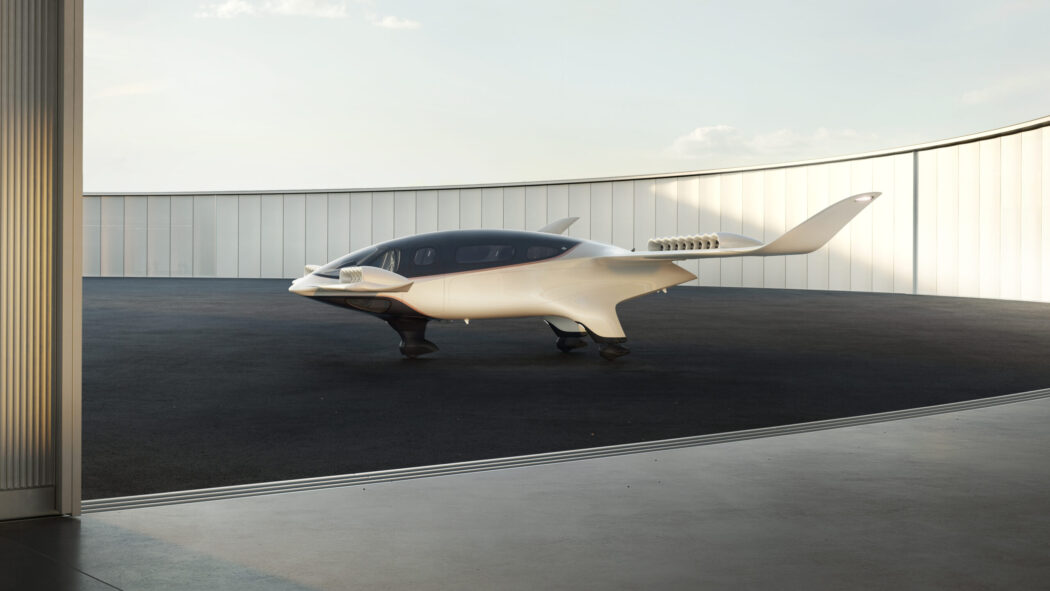

In 2025, Lilium plans to certify its first seven-passenger Lilium Jet. The company reported in September that it is negotiating with EASA on the basis for type certification, including the means of compliance (equivalent to FAA G-2).

EASA is expected to conduct a design organization approval audit in the first half of 2023. In 2024, Lilium plans to build the first type-conforming Lilium Jet and begin testing the aircraft.

It is a pleasure to have a group of supporters of such high quality in such a challenging macroeconomic environment. With this money, we expect to strengthen our balance sheet and advance our commercialization efforts, including signing pre-delivery agreements with customers, reaching an agreement with EASA on our Means of Compliance, and assembling the type-conforming aircraft for the final manned flight test campaign,” Roewe said.